Secured loans mean the person borrowing gives something as a guarantee to the one lending. This thing acts as a security for the lender, lowering the risk involved with the loan. In general, people who borrow may get lesser interest rates and larger borrowing amounts compared to unsecured loans. This article will talk about many details related to secured loans, such as how they work, the different types you can find, and what needs to be done when applying for them.

Explaining Secured Loans and Their Mechanisms

The basic concept of secured loans is tied to collateral. This means that when a borrower takes out a loan, they promise something valuable as security for the lender in case they cannot repay what was borrowed. The term "collateral" can be any property or item that has worth such as real estate (like houses), vehicles, savings accounts, and more. The function of collateral is like insurance for the creditor, because if the borrower doesn't pay back their lent money then this person can legally take hold and sell off whatever was promised - turning it into cash again to get back what they lent out originally. This setup not only lowers danger for the lender, but it frequently brings better loan conditions to borrowers like lesser interest or more money they can borrow.

Also, it's important for those borrowing money to know that the collateral they offer affects how the loan is arranged. Normally, lenders evaluate this asset's value when deciding on loan amount and interest rate. So, borrowers need to give a correct estimation of their assets and clear details during the application process. This will help them get the most beneficial terms for their loan.

- Appraisal Accuracy: Ensure the collateral is accurately appraised to avoid discrepancies in loan terms.

- Asset Versatility: Consider the type of collateral offered and its potential impact on loan terms and conditions.

Understanding the Types of Secured Loans

Loans that are secured can be found in different types, each one made to fit particular money requirements and situations. One common type is the mortgage loan, where the property being financed acts as an assurance. Usually, this kind of loan is used for buying houses or real estate properties. Another well-known secured loan is the auto loan. In this type of lending, the security is provided by the vehicle that you are buying. For people who want to borrow money and have assets such as savings accounts or investment portfolios, they can choose a secured personal loan where their possessions act as collateral. Two more common choices for using assets as security are secured lines of credit and secured credit cards.

Additionally, the borrower must understand that the kind of secured loan they select might influence how the borrowing agreement is structured. For example, mortgage loans usually come with lengthier repayment periods and lesser interest rates in comparison to alternative kinds of secured loans. Conversely, secured credit cards might provide a greater degree of flexibility when it comes to credit caps and potential expenditures.

- Loan Purpose: Choose a secured loan type that aligns with your specific financial goals and borrowing needs.

- Repayment Terms: Evaluate the repayment period and interest rates associated with each type of secured loan to determine the most suitable option.

Exploring the Advantages and Disadvantages of Secured Loans

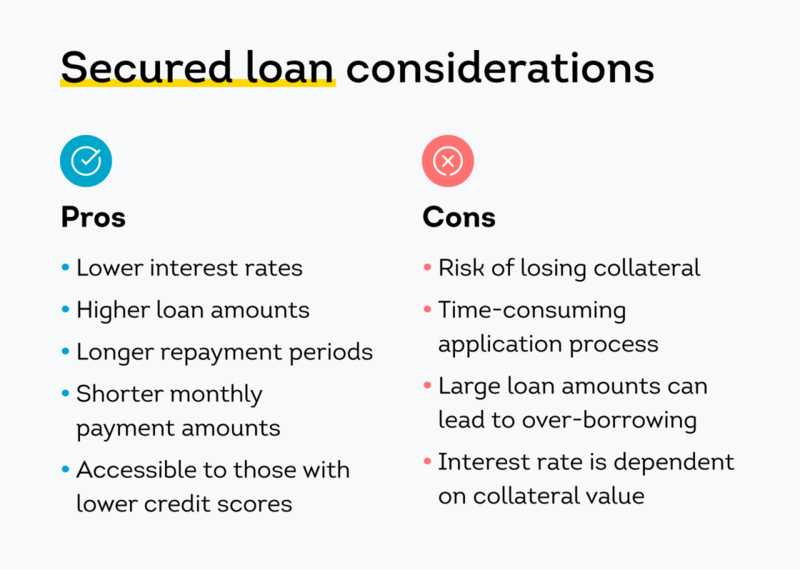

Secured loans have many benefits that make them a preferable choice for borrowing by most people. A big advantage is the usually lower interest rates compared to unsecured loans, which can mean big savings over time, making it good in terms of cost for those who borrow money. Also, secured loans usually have bigger limits for borrowing. This means people can get more money to pay for big things like a house or business investment. Furthermore, secured loans might be easier to obtain for individuals who possess a poor credit history as they are backed by collateral that offers extra security to lenders.

Nevertheless, secured loans have their setbacks that borrowers must contemplate before they proceed. One significant danger is the possibility of losing collateral if there is a default. If the borrower does not pay back the loan as per the agreement, the lender possesses legal power to grab and vend off collateral to make good on their losses. This can lead to serious financial loss and the borrower may lose their asset. Moreover, getting a loan backed by collateral might restrict the flexibility of the person borrowing money because they need to keep that pledged item tied up as protection for the whole period agreed upon in the loan contract.

- Asset Evaluation: Ensure the value of the collateral aligns with the loan amount to minimize the risk of loss in case of default.

- Financial Planning: Assess your ability to repay the loan and consider the potential consequences of defaulting on a secured loan.

Navigating the Loan Application Process

The secured loan application process has a few important steps that borrowers should know to make sure their application goes well and brings success. First of all, you must locate lenders who are fitting and provide the kind of secured loan that matches your financial requirements and conditions. You can search and contrast loan terms, interest rates, as well as qualification standards from various lenders to discover the most beneficial choice available. After picking a lender, you must gather all the documents required for your loan application.

Normally, you'll need to show proof of income like pay stubs or tax returns. This shows that you can repay the loan. You may also be asked for details on the collateral, such as property deeds, vehicle titles, or statements from your savings account. You must provide correct and complete documents. This helps in speeding up the approval of your loan and improves chances for favorable terms on it.

- Organization: Keep all required documents organized and readily accessible to streamline the application process.

- Accuracy: Double-check all documentation for accuracy and completeness before submitting it to the lender.

Tips for Securing a Secured Loan

For a secured loan, you must think carefully and get ready to make sure that your application is approved and you receive good loan conditions. One important thing is to keep up a good credit score because lenders frequently look at the credit history when they evaluate applications for loans. Making sure that information in your credit report is correct by checking it often can assist in enhancing eligibility for a secured loan.

Furthermore, it's very important to accurately determine the value of the collateral being offered. This helps make sure the asset matches with loan amount and conditions. Getting professional appraisals or assessments can give a fair value for the asset and prevent over- or under-evaluation. Also, giving full and correct documents when applying for a loan is necessary to show your financial steadiness and ability to repay money to the lender.

- Terms and Conditions: Thoroughly review the loan agreement terms and conditions to understand your rights and obligations as a borrower.

- Loan Repayment Plan: Develop a realistic repayment plan based on your financial situation to ensure timely repayment of the loan amount.

Conclusion

Secured loans are important financial aids for people who want to borrow money but also keep their risk low. By knowing how secured loans operate, the various types they come in, and the application procedure required, borrowers can make wise choices that match their financial objectives and situation. Just like all kinds of borrowing, it is crucial to think deeply about the conditions and results before you decide on a secured loan deal.