Whether it is our savings or borrowing money, interest rates play an important role in our financial decisions. The purpose of this article is to provide an explanation of two basic types of interest rates: simple and compound. You should understand the difference between them, the method by which they are calculated, and the impact they might have on your finances in order to make informed financial decisions. So Without Further ado, let's get started.

What is Simple Interest?

An interest rate that applies only to the original investment is known as simple interest. Whether the investment was made recently or a long time ago, it does not matter.

Unlike a deposit, an investment doesn't add the interest earned to the principal. There are two ways in which the bank can pay interest:

- After the deposit period has ended;

- Payable on a monthly basis.

Investments in corporate bonds and treasuries are examples. Coupon payments are made to the investor's account on a regular basis, and they are always calculated based on the par value of the stock. When lending money, interest is usually accrued daily, but only on the amount owed. Such a scheme, for example, is used by mortgage lenders, consumer finance companies, and so on.

The Working of Simple Interest

In the case of simple interest, the investor receives a fixed income over the course of time. It is generally used by individuals who are interested in a steady cash flow rather than accumulating capital quickly.

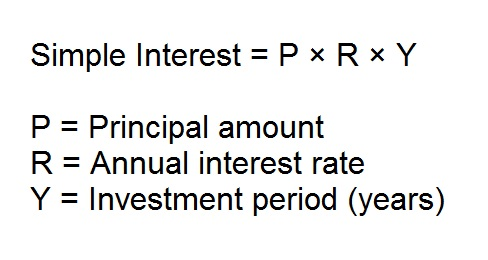

Simple Interest Formula

By using the following formula, simple interest brought by deposits, bonds, etc., can be calculated.

Therefore, if 10% simple interest is charged on a $5,000 loan taken out for 4 years, then the borrower would be responsible for $2000 in interest. [Calculation: 5000 x 0.1 x 4 = $2000]

Over the course of four years, this loan will have an interest rate of $500 per year, or $2000 total.

What is Compound Interest?

The interest accrued over the principal balance as well as on all amounts paid out during the previous period, is included in this calculation. Accordingly, the longer the money remains in the account, the greater the income earned by the investor.

The profit margin can be calculated on a daily basis, but it is typically reported to the deposit body less frequently. A high-yield savings account may be paid monthly, while a Series I bond may be paid semiannually.

When a deposit is made with a bank, the deposit body increments automatically. An investor earns interest when investing, but the value of the security is not affected by this interest. In order to maximise the amount of future payments, it is necessary to purchase additional assets with the money received.

Working of Compound Interest

Using income reinvestment, the basis for calculating future instalments is as follows:

- An investor receives interest on his or her deposit during the first period;

- As a result of the interest added to the deposit at the end of the first period, the interest rate will increase in the second period; thus, the payment is increased;

- At the end of the third period, you receive a payment on your investment plus any interest that has been added (the payment is even greater than in the second period).

In the early months and even years after reinvestment, the effect is minimal. However, when we take a longer-term view, it plays a very important role in capital accumulation.

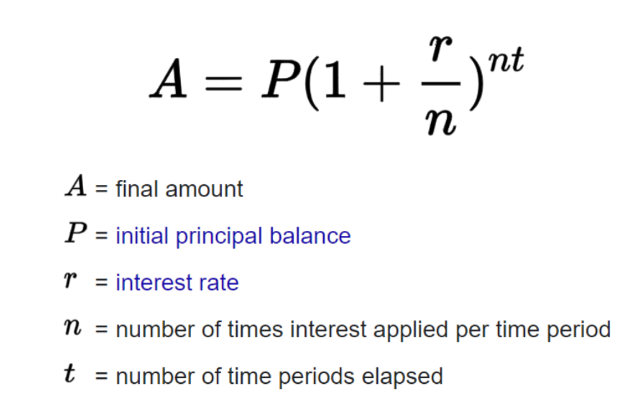

Compound Interest Formula

Here is the formula for calculating compound interest.

A compound interest rate is calculated as the sum of the principal and interest over the future period (or future value) minus the current principal amount, which is called the present value (PV). PV represents the present value of a cash flow stream in the future, given a set rate of return.

Using the simple interest example once again, what would the compound interest amount be? It would be as follows:

Calculation

[$5000((1+0.1)4-1)

= $2320.5]

Although the total interest payable over this loan's three-year term is $2320, compound interest does not result in the same amount of interest over all three years since accumulated interest is also factored in. As shown in the table below, interest is due at the end of each year.

Year | Opening Balance | Interest at 10% | Closing Balance |

1 | $5000 | $580 | $5580 |

2 | $5580 | $580 | $6160 |

3 | $6160 | $580 | $6740 |

4 | $6740 | $580 | $7320 |

Total Interest | $2320 |

What is The Rule of 72?

Using the Rule of 72, we can estimate the approximate duration of time necessary for an investment to double under given conditions ("i", where 72 is the rate of interest).

Although it is only useful for annual compounding, it can be very helpful when planning your retirement financial situation. A 6% annual return investment, for instance, would double in 12 years (72/6%).

Investing with an annual rate of return of 8% will double in nine years (72 /8%). This refers to the fact that the number of compounding periods per year is divided by the number of "i" or interest rates within the parentheses. The value of "n" should be multiplied by "t," the investment's total duration, outside of the parentheses.

How Does Compound Interest Compare to Simple Interest?

There is a difference between investing and borrowing. As a result of compound interest, the principal grows exponentially over time because interest is calculated on both the principal and interest accumulated over time. If you invest your money, it will grow at a faster rate. A loan, however, can cause compound interest to create a snowball effect, exponentially increasing your debt. With simple interest, you will pay less over the course of the loan.

How Does Simple Interest Work in Financial Applications?

The majority of bonds with coupon payments, mortgages, and personal loans use simple interest as the calculation method. Typically, compound interest is applied to bank deposits, credit cards, and some lines of credit.

Conclusion

The interest rate on a loan can have a significant impact on how much you will pay over the course of the loan. Therefore, it is important to consider whether the interest on the loan is compound or simple before borrowing. Other than that, we hope you get the idea of how both interests work after reading this article.